Understanding ERCOT vs MISO—and Why It Matters for Site Development

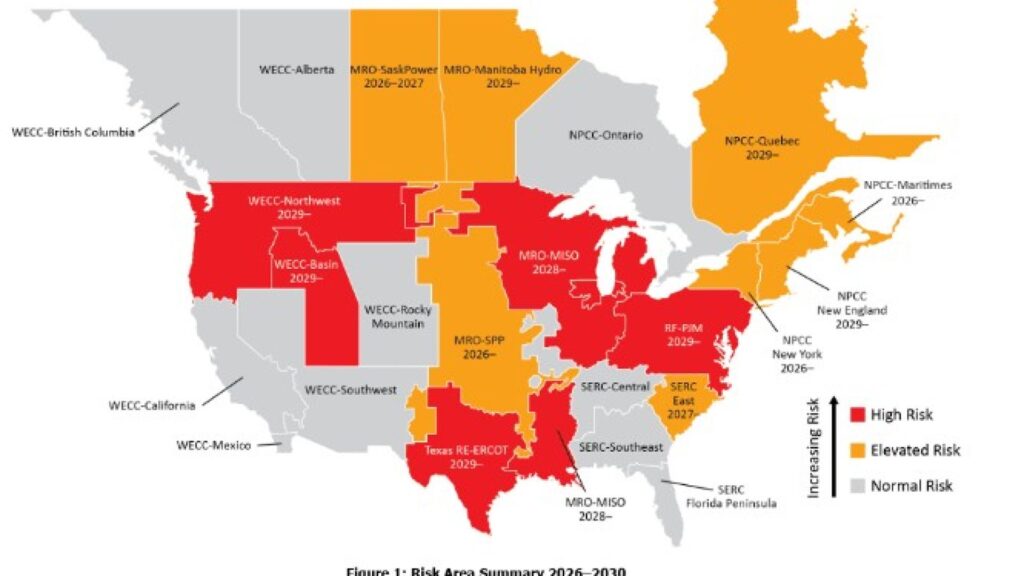

East Texas sits at a rare and often misunderstood intersection of two very different infrastructure systems. Depending on location, a site may fall under either ERCOT or MISO, with materially different implications for power cost, project timelines, and competitiveness.

At the same time, East Texas occupies a strategic middle ground for fiber routes, rail access, and resilient communications, making it attractive for industrial, logistics, and emerging compute-intensive projects—if planned correctly.

For economic planners and site developers, understanding these differences early can mean the difference between a project that advances smoothly and one that stalls after capital is committed.

Two Grids, Two Economic Models

ERCOT: Energy-Only, Fast-Moving, Market-Driven

Areas of East Texas tied to ERCOT operate in an energy-only market. Generators are paid for energy produced, not for forward capacity commitments.

Key characteristics:

- No formal capacity charges

- Generally, lower average energy prices

- Faster response to load growth

- Greater price volatility during extreme events

For developers, ERCOT can be attractive because large new loads are not penalized upfront. However, volatility must be managed through thoughtful design, often involving on-site generation or storage.

MISO: Capacity-Based, Stable—but Costly at Scale

East Texas areas connected to MISO operate in a capacity market, layered on top of energy pricing.

Key characteristics:

- Large loads pay for future system capacity

- Higher fixed cost floor per megawatt

- Longer interconnection and upgrade timelines

- Conservative planning assumptions

For traditional industrial loads, this model has provided stability. For power-dense or fast-growing projects, capacity charges and timelines can become a structural disadvantage if not addressed early.

Why This Matters for Economic Development

From a site-development perspective, the grid is not just a utility—it is part of the economic equation.

- In ERCOT areas, projects tend to compete on total operating cost and speed to market

- In MISO areas, projects compete on how effectively they reduce dependence on the bulk grid

Neither grid is “better” in the abstract. They are different systems, and successful projects are designed to work with those differences rather than against them.

Power Density Has Changed the Conversation

Modern industrial projects—advanced manufacturing, logistics automation, data-driven operations, and AI-adjacent facilities—exhibit characteristics that older planning models did not anticipate:

- Large step loads instead of gradual growth

- Continuous, non-diverse demand

- Tight tolerance for voltage and frequency excursions

- Business timelines measured in months, not years

In both ERCOT and MISO, this has shifted the planning question from:

“Is there power available?”

to:

“Can the system absorb and control this load without disruption?”

This is where early engineering analysis becomes essential.

Fiber Access in East Texas: Opportunity with Caveats

East Texas benefits from proximity to major long-haul fiber corridors connecting Houston, Dallas, Louisiana, and the Gulf Coast. In many cases, fiber is nearby—but not on site.

Practical realities:

- Fiber routes often parallel highways, pipelines, or rail

- Last-mile extensions can take 9–18 months

- Single-carrier dependency is common without advance planning

- Route diversity is not guaranteed unless explicitly designed

For site developers, fiber availability should be evaluated with the same rigor as power:

- Who owns the route?

- How many physically diverse paths exist?

- What is the realistic delivery timeline?

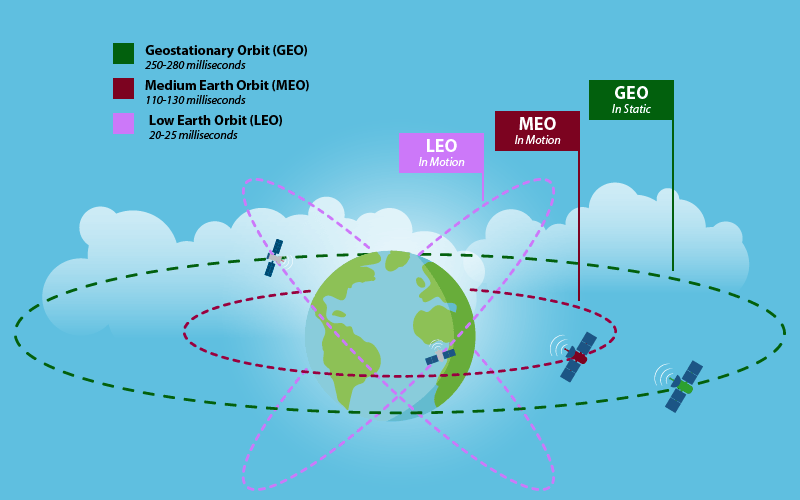

The Role of “Rescue” Connectivity: Satellite as a Complement

Satellite connectivity has become a valuable planning tool in East Texas—but expectations must be realistic.

Commercial satellite services today typically provide:

- Hundreds of megabits per second per terminal (LEO)

- Up to low-single-digit gigabits per site for premium MEO services

- Rapid deployment compared to terrestrial builds

- True physical path diversity from ground infrastructure

What satellite does well:

- Accelerates early site activation

- Provides continuity during fiber outages

- Supports control, monitoring, and backup operations

What it does not replace:

- High-volume, low-latency fiber backbones

Used correctly, satellite acts as resilience and time-to-market insurance, not a substitute for fiber.

Designing Competitive Sites in Both ERCOT and MISO Areas

The most successful East Texas projects share common planning traits:

- Early differentiation between ERCOT and MISO economics

- Realistic assumptions about utility timelines

- Hybrid power strategies where appropriate

- Proactive fiber route analysis

- Backup connectivity that eliminates single points of failure

In ERCOT areas, this often means using the grid aggressively but responsibly.

In MISO areas, it often means reducing reliance on the grid through local solutions.

In both cases, credibility with investors and end users depends on honest, technically grounded planning.

What This Means for Economic Planners and Developers

For communities and developers in East Texas, the takeaway is not pessimistic—it is empowering.

Projects fail less often because of geography than because:

- Infrastructure differences were misunderstood

- Marketing claims outpaced physical reality

- Engineering was deferred until too late

Regions that succeed are those that:

- Understand their grid

- Understand their fiber

- Design sites that respect both

Closing Thought

East Texas is well-positioned for the next generation of industrial and digital development—but only for projects engineered for their actual locations.

Understanding the difference between ERCOT and MISO, planning realistically for power and bandwidth, and using satellite connectivity as a resilience tool—not a crutch—allows sites to compete on substance, not slogans.

For economic planners and site developers, that understanding is no longer optional. It is now part of doing the work well.